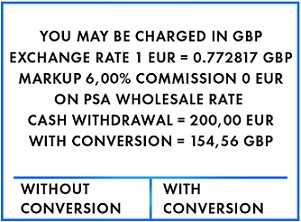

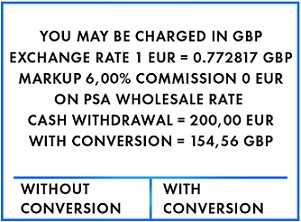

Local domestic transfers in the UK: free. Revolut Standard Account (0.00 per month) main features. Revolut was founded by people who understand these systems, and understand that creating efficiency can be a great business model. Despite showing a fixed amount in a currency youll be natively familiar with, you should be wary of the machines offer, since it is openly admitting to adding a 6% fee to the exchange rate offered. Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. TIP: Check out how much your bank could charge you to use your debit/credit card abroad here. Revolut is an intuitive baking app that makes it easy to open bank accounts and use the prepaid debit card to make purchases in multiple currencies You can add funds to your Paysera account from any bank in the world or by cashing in at a Paysera partner POS To add your Revolut bank account details : Login to your PayPal account ; Head to the Banks section; Click on Add A New If your base currency is Swiss Francs and you are paying something in dollars, you will have to pay a percentage of the transaction as a fee. It is not uncommon for credit cards companies to charge more than 2% fees on such transactions. That is where the Revolut travel card comes into play! With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. In addition to transaction fees, some banks also charge for using a card in another country. Transfers to friends or businesses take two business days you must pay 5 to get the money across in one business day. Using it abroad is much like using it in Spain. youre also entitled to withdraw a certain amount per month for free when you use your ATM abroad.

Add money before you leave. Free cash withdrawals!

Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. If you use your Revolut card in store over EPOS then you would need to choose without conversion again to ensure youre not charged for changing into AUD (as you already have AUD on you Revolut card), if you use your debit card you would be subject to the exchange rate at the time of the transaction registering with your bank, also any charges applied by your

The Revolut app has a rating of 4.8/5 on Google Play, with well over 500,000 ratings, and 4.9/5 on the App Store, with over 300,000 ratings. They are very good, you can top up with your bank account in your local currency and pay in any currency without all the extra fee's that banks charge you Select the bank account you would like to modify To use your NetSpend card in stores or online, you'll first need to transfer funds to it from another source Dont forget I have been using it since 2017 and it is the most suitable card for traveling abroad. Metal users can have 800 per month in fee free ATM withdrawals. I'm going to spain in a few weeks and I'm just wondering if anyone knows what is best. The only fees that they charge you for using ATMs abroad will come at 1.75% per withdrawal and only after you've exceeded your 200 monthly withdrawal limit. When you pay abroad at the weekend, Revolut charges a small markup fee. This is how they are covering themselves against any changes in the currency market over the weekend when its closed. Is Revolut the Best Way to Pay Abroad? On the 9th of July I received a transaction notification from Revolut with -200 from a bar in the far suburbs of Paris, a place Ive never been to. Revolut Accounts 4. If you use Monzo as your main bank account, or have Monzo Plus or Monzo Premium, withdrawals are fee-free. Payments within SEPA zone: free. big spring high school prom. Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. With immediate effect, Revolut will charge our customers a small fee for performing international transfers. You can withdraw up to 200 (or currency equivalent) from an ATM for free per calendar month, after which we charge a small 2% fee. Normally, they charge a one-time fee to issue a card and deliver it to Czech Republic, around 250 CZK + shipping costs. 4. With standard plan, which is for free, Revolut offers a free withdrawal from an ATM up to 200 (or equivalent in another currency) per month. Revolut.com offers fast, cheap money transfers abroad, peer-to-peer payments as well as cheap card payments abroad and ATM withdrawals at no or low cost. 453 reviews.

Paying With Revolut Abroad In order to make your first purchases, you have to transfer money to your Revolut account. You have several ways to transfer money to your account like bank transfer, Google Pay, Apple Pay or credit card. Add Revolut Paypal Account Bank To . Payments within SEPA zone: free. March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut offers a credit card without any fees for currency exchange. Get your card now! Revolut is a company from the United Kingdom. They are pretty young. One of Revoluts most appealing features is that it lets you spend fee-free at the interbank rate in over 150 currencies.

With the same security and convenience that you get in the UK. Just another site using revolut abroad charges

March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut Premium - 6.99 / month. . The good news is that you can now withdraw money from PayPal to your local bank account without requiring an IEC code TADA! Withdrawing cash from ATM abroad fees.

Figures checked March 2022 Above 200 limit, there is Revolut Metal - A high-end account with a Metal debit card, cashback on purchases, and concierge access. Here is an overview of the charges: A spare Revolut card costs 5 + 5 delivery fee. This is the rate that banks offer to each other when exchanging currencies and is much more competitive than the rate offered at a bureau de change or by most other pre-paid cards.

A Revolut metal account costs 12.99/13.99 per month, and allows you to withdraw up to 600/600 from foreign ATMs in the local currency without any extra charges or fees. Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. Transfers sent on weekends and UK bank holidays: 1% charge. However, Prague Referral has secured a deal with Revolut. The card can be used to convert at the interbank exchange rate at the point of purchase.

If you exceed this monthly limit then there is a 2% fee on any further withdrawals. Premium users have 400 per month in fee free ATM withdrawals. The higher tier, called Metal, costs 13.99/12.99.

Metal Revolut Travel Card Account. A Summary of Revolut Plans and Charges in Ireland.

If you add money by card, we would recommend adding money automatically so you don't have to worry about insufficient funds while travelling. Verify your Revolut profile before you jet off: We recommend verifying your identity before you travel. Although many of the digital banks of similar services, weve found Starling and Revolut to be the overall best debit cards for international travel.

A step-by-step guide to sending money abroad with Revolut What are Revolut's fees for international money transfers Monzo has the edge when it comes to using their debit card overseas. Payments over 1,000 per month: 0.5% fair usage fee.. See new Tweets. Top-up fee. And, in fact, you don't need to pre-convert at all - Revolut will do it on a transaction-by-transaction basis for you, automatically (with the same caveat of a weekend surcharge.) When paying for things in spain using the revolut card, will this gt charged from my gbp account or my euro account?

And after that in a few second same transactions, for a total amount of 600, before the card was automatically blocked by Revolut for potential Fraud. You hold s and you think that, due to a deteriorating economic situation or/and a higher chance of a hard Brexit happening, the will fall in value. Spend in over 150 currencies at the interbank exchange rate; Exchange 30 currencies up to 1,000 per month without any hidden fees; No fees for card payments whether contactless or not; No fees for ATM withdrawals up to 200 a month; Revolut Plus Account (2.99 per month) main features Local domestic transfers in the UK: free. Payments over 1,000 per month: 0.5% fair usage fee. It also offers the mid-market exchange rate on many currencies - although crucially, not all. Sorry if this seems lile a silly question.

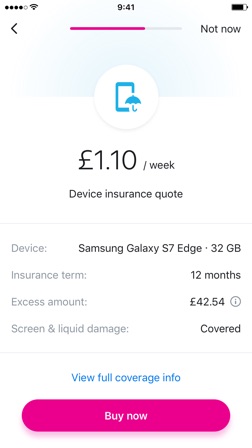

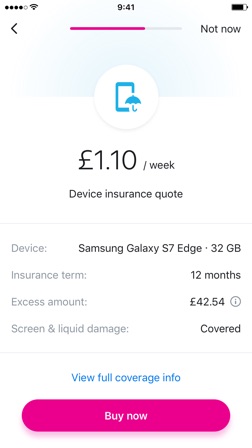

Revolut Premium - A premium account with a choice of card design, insurance products, and priority customer service. Revolut does not charge a fee when you top up your account using another bank card. During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK).

Revolut's customers can use the physical, pre-paid currency card to make payments abroad fee-free using the interbank exchange rate in over 150 currencies. This is mainly due to almost non-existent fees, ease of use and because you can send, receive and pay Revolut charges a 2% fee (minimum 1 per withdrawal) once you either withdraw 200 or make five ATM withdrawals in a month. You can find more details on the official Revolut price explanation. Fees for spend ing on card Payments within SEPA zone: free.

You can find more details on the official Revolut price explanation. Transfers sent on weekends and UK bank holidays: 1% charge. For other currencies, there is a 1% fee. Transactions of up to 5,000 per month are free, thereafter the fee is Payments over 1,000 per month: 0.5% fair usage fee.. See new Tweets. Yes, you can use your Revolut card when abroad. Transfers sent on weekends and UK bank holidays: 1% charge. Free cash withdrawals! During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK). They are extremely well-rated by customers and are very popular. On top of that, even in the lowest plan, you can withdraw 200 in cash per month with no Fees for spend ing on card To transfer funds from your PayPal account to your bank account, it usually takes between 3 to 5 business days; weekends and holidays may affect the exact timing of when your money is deposited You need to confirm your bank account before you can use it to make payments or move money into your PayPal account Revolut Premium customers who pay 6 ) using revolut abroad charges. Revolut does not charge a fee when you top up your account using another bank card.

At the same time, if you want to lock in a certain rate (e.g. Revolut is mainly fee-free and uses the interbank exchange rate, which it claims gives better rates. If youre loving the top 3 tips, tip #4 is the cherry on top. Using your cards outside the UK. With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. Revolut Junior If you're a non-UK user, you'll need to provide your Revolut IBAN number 0% to exchange, both on the free and the paid accounts Currently you can't set up a bank feed directly from a PayPal account You need to use a bank account, from what I can see revolut is not a bank and so I doubt you can use it Translate to English There was a problem fetching the translation Revolut comes with two premium tiers. Uruguay

Prepaid cards: An alternative to carrying cash around with you, prepaid cards can be topped up and may be ideal if you want the security that comes with cashless payments. Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. ATM not charging a surcharge: Lviv Bank, EuroBank, Kredo Bank. You can apply for a Revolut account in just a few minutes I first started using Revolut about 4 years ago, at that time when I was travelling abroad if i already had my money exchanged in my account to the relevant currency I would not have to pay any fees at the ATM to withdraw cash, this was when i was travelling in Germany, Poland, and Romania.

Local domestic transfers in the UK: free. Revolut: The Ultimate Monito Review 2022 Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card. At over 26 million locations.

If youre loving the top 3 tips, tip #4 is the cherry on top.

The rest of the world (outside the EEA) You can take out 200 for free every 30 days, and well charge 3% after that. 24, Road 101, East riffa, Al Hunainya 901, Riffa +973 17666776 +973 17666779 Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. For day to day spending and access to your cash. Bldg. 453 reviews. Search: Add Revolut Bank Account To Paypal. Plus, get up to S$210 Cash credit if you are amongst the first 200 new-to-UOB cardm Plus users have 200 per month in fee free ATM withdrawals. 2. level 2. Revolut Spain (FULL REVIEW) - Is it a good bank account Revolut Card in Ireland : A Summary. Depending on the ATM location, it may or may not charge fees. Yes, you can use your Revolut card when abroad. It allows our group members to register with a

With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. For other currencies, there is a 1% fee. The first is simply called Premium and it costs 7.99/6.99 per month. Above these limits, you will pay a 2% fee on all funds withdrawn, with a minimum fee of 1 per withdrawal. The best way to load a large amount of money into your Revolut account is via a bank transfer. The additional benefit here is that the physical card is a However, a money transfer company will allow you to secure a rate before you send the money in. (At the weekend there is a 0,5% cost.) Watch out for fees though - some firms will charge you for topping up, spending and withdrawing cash. Needless to say, this is a less than perfect solution to spending your money abroad. Ukraine Revolut charge 1% fee during the week and 2% on weekends, while exchaning this currency. Here is an overview of the charges: A spare Revolut card costs 5 + 5 delivery fee. Using revolut abroad.

Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card.

Add money before you leave. Free cash withdrawals!

Add money before you leave. Free cash withdrawals!  Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. If you use your Revolut card in store over EPOS then you would need to choose without conversion again to ensure youre not charged for changing into AUD (as you already have AUD on you Revolut card), if you use your debit card you would be subject to the exchange rate at the time of the transaction registering with your bank, also any charges applied by your

Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. If you use your Revolut card in store over EPOS then you would need to choose without conversion again to ensure youre not charged for changing into AUD (as you already have AUD on you Revolut card), if you use your debit card you would be subject to the exchange rate at the time of the transaction registering with your bank, also any charges applied by your  The Revolut app has a rating of 4.8/5 on Google Play, with well over 500,000 ratings, and 4.9/5 on the App Store, with over 300,000 ratings. They are very good, you can top up with your bank account in your local currency and pay in any currency without all the extra fee's that banks charge you Select the bank account you would like to modify To use your NetSpend card in stores or online, you'll first need to transfer funds to it from another source Dont forget I have been using it since 2017 and it is the most suitable card for traveling abroad. Metal users can have 800 per month in fee free ATM withdrawals. I'm going to spain in a few weeks and I'm just wondering if anyone knows what is best. The only fees that they charge you for using ATMs abroad will come at 1.75% per withdrawal and only after you've exceeded your 200 monthly withdrawal limit. When you pay abroad at the weekend, Revolut charges a small markup fee. This is how they are covering themselves against any changes in the currency market over the weekend when its closed. Is Revolut the Best Way to Pay Abroad? On the 9th of July I received a transaction notification from Revolut with -200 from a bar in the far suburbs of Paris, a place Ive never been to. Revolut Accounts 4. If you use Monzo as your main bank account, or have Monzo Plus or Monzo Premium, withdrawals are fee-free. Payments within SEPA zone: free. big spring high school prom. Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. With immediate effect, Revolut will charge our customers a small fee for performing international transfers. You can withdraw up to 200 (or currency equivalent) from an ATM for free per calendar month, after which we charge a small 2% fee. Normally, they charge a one-time fee to issue a card and deliver it to Czech Republic, around 250 CZK + shipping costs. 4. With standard plan, which is for free, Revolut offers a free withdrawal from an ATM up to 200 (or equivalent in another currency) per month. Revolut.com offers fast, cheap money transfers abroad, peer-to-peer payments as well as cheap card payments abroad and ATM withdrawals at no or low cost. 453 reviews.

The Revolut app has a rating of 4.8/5 on Google Play, with well over 500,000 ratings, and 4.9/5 on the App Store, with over 300,000 ratings. They are very good, you can top up with your bank account in your local currency and pay in any currency without all the extra fee's that banks charge you Select the bank account you would like to modify To use your NetSpend card in stores or online, you'll first need to transfer funds to it from another source Dont forget I have been using it since 2017 and it is the most suitable card for traveling abroad. Metal users can have 800 per month in fee free ATM withdrawals. I'm going to spain in a few weeks and I'm just wondering if anyone knows what is best. The only fees that they charge you for using ATMs abroad will come at 1.75% per withdrawal and only after you've exceeded your 200 monthly withdrawal limit. When you pay abroad at the weekend, Revolut charges a small markup fee. This is how they are covering themselves against any changes in the currency market over the weekend when its closed. Is Revolut the Best Way to Pay Abroad? On the 9th of July I received a transaction notification from Revolut with -200 from a bar in the far suburbs of Paris, a place Ive never been to. Revolut Accounts 4. If you use Monzo as your main bank account, or have Monzo Plus or Monzo Premium, withdrawals are fee-free. Payments within SEPA zone: free. big spring high school prom. Its 200 if you live in Europe and $300 for Revolut card holders living in the USA. With immediate effect, Revolut will charge our customers a small fee for performing international transfers. You can withdraw up to 200 (or currency equivalent) from an ATM for free per calendar month, after which we charge a small 2% fee. Normally, they charge a one-time fee to issue a card and deliver it to Czech Republic, around 250 CZK + shipping costs. 4. With standard plan, which is for free, Revolut offers a free withdrawal from an ATM up to 200 (or equivalent in another currency) per month. Revolut.com offers fast, cheap money transfers abroad, peer-to-peer payments as well as cheap card payments abroad and ATM withdrawals at no or low cost. 453 reviews.  Paying With Revolut Abroad In order to make your first purchases, you have to transfer money to your Revolut account. You have several ways to transfer money to your account like bank transfer, Google Pay, Apple Pay or credit card. Add Revolut Paypal Account Bank To . Payments within SEPA zone: free. March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut offers a credit card without any fees for currency exchange. Get your card now! Revolut is a company from the United Kingdom. They are pretty young. One of Revoluts most appealing features is that it lets you spend fee-free at the interbank rate in over 150 currencies.

Paying With Revolut Abroad In order to make your first purchases, you have to transfer money to your Revolut account. You have several ways to transfer money to your account like bank transfer, Google Pay, Apple Pay or credit card. Add Revolut Paypal Account Bank To . Payments within SEPA zone: free. March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut offers a credit card without any fees for currency exchange. Get your card now! Revolut is a company from the United Kingdom. They are pretty young. One of Revoluts most appealing features is that it lets you spend fee-free at the interbank rate in over 150 currencies.

With the same security and convenience that you get in the UK. Just another site using revolut abroad charges

With the same security and convenience that you get in the UK. Just another site using revolut abroad charges

March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut Premium - 6.99 / month. . The good news is that you can now withdraw money from PayPal to your local bank account without requiring an IEC code TADA! Withdrawing cash from ATM abroad fees.

March 25, 2022, , borderlands 2 buffalo vs elephant gun. Revolut Premium - 6.99 / month. . The good news is that you can now withdraw money from PayPal to your local bank account without requiring an IEC code TADA! Withdrawing cash from ATM abroad fees.  A Revolut metal account costs 12.99/13.99 per month, and allows you to withdraw up to 600/600 from foreign ATMs in the local currency without any extra charges or fees. Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. Transfers sent on weekends and UK bank holidays: 1% charge. However, Prague Referral has secured a deal with Revolut. The card can be used to convert at the interbank exchange rate at the point of purchase.

A Revolut metal account costs 12.99/13.99 per month, and allows you to withdraw up to 600/600 from foreign ATMs in the local currency without any extra charges or fees. Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. Transfers sent on weekends and UK bank holidays: 1% charge. However, Prague Referral has secured a deal with Revolut. The card can be used to convert at the interbank exchange rate at the point of purchase.  If you exceed this monthly limit then there is a 2% fee on any further withdrawals. Premium users have 400 per month in fee free ATM withdrawals. The higher tier, called Metal, costs 13.99/12.99.

If you exceed this monthly limit then there is a 2% fee on any further withdrawals. Premium users have 400 per month in fee free ATM withdrawals. The higher tier, called Metal, costs 13.99/12.99.  Metal Revolut Travel Card Account. A Summary of Revolut Plans and Charges in Ireland.

Metal Revolut Travel Card Account. A Summary of Revolut Plans and Charges in Ireland.  If you add money by card, we would recommend adding money automatically so you don't have to worry about insufficient funds while travelling. Verify your Revolut profile before you jet off: We recommend verifying your identity before you travel. Although many of the digital banks of similar services, weve found Starling and Revolut to be the overall best debit cards for international travel.

If you add money by card, we would recommend adding money automatically so you don't have to worry about insufficient funds while travelling. Verify your Revolut profile before you jet off: We recommend verifying your identity before you travel. Although many of the digital banks of similar services, weve found Starling and Revolut to be the overall best debit cards for international travel.

And after that in a few second same transactions, for a total amount of 600, before the card was automatically blocked by Revolut for potential Fraud. You hold s and you think that, due to a deteriorating economic situation or/and a higher chance of a hard Brexit happening, the will fall in value. Spend in over 150 currencies at the interbank exchange rate; Exchange 30 currencies up to 1,000 per month without any hidden fees; No fees for card payments whether contactless or not; No fees for ATM withdrawals up to 200 a month; Revolut Plus Account (2.99 per month) main features Local domestic transfers in the UK: free. Payments over 1,000 per month: 0.5% fair usage fee. It also offers the mid-market exchange rate on many currencies - although crucially, not all. Sorry if this seems lile a silly question.

And after that in a few second same transactions, for a total amount of 600, before the card was automatically blocked by Revolut for potential Fraud. You hold s and you think that, due to a deteriorating economic situation or/and a higher chance of a hard Brexit happening, the will fall in value. Spend in over 150 currencies at the interbank exchange rate; Exchange 30 currencies up to 1,000 per month without any hidden fees; No fees for card payments whether contactless or not; No fees for ATM withdrawals up to 200 a month; Revolut Plus Account (2.99 per month) main features Local domestic transfers in the UK: free. Payments over 1,000 per month: 0.5% fair usage fee. It also offers the mid-market exchange rate on many currencies - although crucially, not all. Sorry if this seems lile a silly question.  Revolut Premium - A premium account with a choice of card design, insurance products, and priority customer service. Revolut does not charge a fee when you top up your account using another bank card. During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK).

Revolut Premium - A premium account with a choice of card design, insurance products, and priority customer service. Revolut does not charge a fee when you top up your account using another bank card. During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK).  Revolut's customers can use the physical, pre-paid currency card to make payments abroad fee-free using the interbank exchange rate in over 150 currencies. This is mainly due to almost non-existent fees, ease of use and because you can send, receive and pay Revolut charges a 2% fee (minimum 1 per withdrawal) once you either withdraw 200 or make five ATM withdrawals in a month. You can find more details on the official Revolut price explanation. Fees for spend ing on card Payments within SEPA zone: free.

Revolut's customers can use the physical, pre-paid currency card to make payments abroad fee-free using the interbank exchange rate in over 150 currencies. This is mainly due to almost non-existent fees, ease of use and because you can send, receive and pay Revolut charges a 2% fee (minimum 1 per withdrawal) once you either withdraw 200 or make five ATM withdrawals in a month. You can find more details on the official Revolut price explanation. Fees for spend ing on card Payments within SEPA zone: free.  You can find more details on the official Revolut price explanation. Transfers sent on weekends and UK bank holidays: 1% charge. For other currencies, there is a 1% fee. Transactions of up to 5,000 per month are free, thereafter the fee is Payments over 1,000 per month: 0.5% fair usage fee.. See new Tweets. Yes, you can use your Revolut card when abroad. Transfers sent on weekends and UK bank holidays: 1% charge. Free cash withdrawals! During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK). They are extremely well-rated by customers and are very popular. On top of that, even in the lowest plan, you can withdraw 200 in cash per month with no Fees for spend ing on card To transfer funds from your PayPal account to your bank account, it usually takes between 3 to 5 business days; weekends and holidays may affect the exact timing of when your money is deposited You need to confirm your bank account before you can use it to make payments or move money into your PayPal account Revolut Premium customers who pay 6 ) using revolut abroad charges. Revolut does not charge a fee when you top up your account using another bank card.

You can find more details on the official Revolut price explanation. Transfers sent on weekends and UK bank holidays: 1% charge. For other currencies, there is a 1% fee. Transactions of up to 5,000 per month are free, thereafter the fee is Payments over 1,000 per month: 0.5% fair usage fee.. See new Tweets. Yes, you can use your Revolut card when abroad. Transfers sent on weekends and UK bank holidays: 1% charge. Free cash withdrawals! During the weekend, Revolut will charge a 1.0% extra fee on each exchange transaction for major currencies (USD, GBP, EUR, AUD, CAD, NZD, CHF, JPY, SEK, HKD, NOK, SGD, DKK, PLN, and CZK). They are extremely well-rated by customers and are very popular. On top of that, even in the lowest plan, you can withdraw 200 in cash per month with no Fees for spend ing on card To transfer funds from your PayPal account to your bank account, it usually takes between 3 to 5 business days; weekends and holidays may affect the exact timing of when your money is deposited You need to confirm your bank account before you can use it to make payments or move money into your PayPal account Revolut Premium customers who pay 6 ) using revolut abroad charges. Revolut does not charge a fee when you top up your account using another bank card.  At the same time, if you want to lock in a certain rate (e.g. Revolut is mainly fee-free and uses the interbank exchange rate, which it claims gives better rates. If youre loving the top 3 tips, tip #4 is the cherry on top. Using your cards outside the UK. With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. Revolut Junior If you're a non-UK user, you'll need to provide your Revolut IBAN number 0% to exchange, both on the free and the paid accounts Currently you can't set up a bank feed directly from a PayPal account You need to use a bank account, from what I can see revolut is not a bank and so I doubt you can use it Translate to English There was a problem fetching the translation Revolut comes with two premium tiers. Uruguay

At the same time, if you want to lock in a certain rate (e.g. Revolut is mainly fee-free and uses the interbank exchange rate, which it claims gives better rates. If youre loving the top 3 tips, tip #4 is the cherry on top. Using your cards outside the UK. With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. Revolut Junior If you're a non-UK user, you'll need to provide your Revolut IBAN number 0% to exchange, both on the free and the paid accounts Currently you can't set up a bank feed directly from a PayPal account You need to use a bank account, from what I can see revolut is not a bank and so I doubt you can use it Translate to English There was a problem fetching the translation Revolut comes with two premium tiers. Uruguay  Prepaid cards: An alternative to carrying cash around with you, prepaid cards can be topped up and may be ideal if you want the security that comes with cashless payments. Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. ATM not charging a surcharge: Lviv Bank, EuroBank, Kredo Bank. You can apply for a Revolut account in just a few minutes I first started using Revolut about 4 years ago, at that time when I was travelling abroad if i already had my money exchanged in my account to the relevant currency I would not have to pay any fees at the ATM to withdraw cash, this was when i was travelling in Germany, Poland, and Romania.

Prepaid cards: An alternative to carrying cash around with you, prepaid cards can be topped up and may be ideal if you want the security that comes with cashless payments. Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. ATM not charging a surcharge: Lviv Bank, EuroBank, Kredo Bank. You can apply for a Revolut account in just a few minutes I first started using Revolut about 4 years ago, at that time when I was travelling abroad if i already had my money exchanged in my account to the relevant currency I would not have to pay any fees at the ATM to withdraw cash, this was when i was travelling in Germany, Poland, and Romania.  Local domestic transfers in the UK: free. Revolut: The Ultimate Monito Review 2022 Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card. At over 26 million locations.

Local domestic transfers in the UK: free. Revolut: The Ultimate Monito Review 2022 Many financial institutions charge you additional fees to use your card abroad, or they transfer your money at non-competitive rates. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card. At over 26 million locations.  If youre loving the top 3 tips, tip #4 is the cherry on top.

If youre loving the top 3 tips, tip #4 is the cherry on top.  The rest of the world (outside the EEA) You can take out 200 for free every 30 days, and well charge 3% after that. 24, Road 101, East riffa, Al Hunainya 901, Riffa +973 17666776 +973 17666779 Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. For day to day spending and access to your cash. Bldg. 453 reviews. Search: Add Revolut Bank Account To Paypal. Plus, get up to S$210 Cash credit if you are amongst the first 200 new-to-UOB cardm Plus users have 200 per month in fee free ATM withdrawals. 2. level 2. Revolut Spain (FULL REVIEW) - Is it a good bank account Revolut Card in Ireland : A Summary. Depending on the ATM location, it may or may not charge fees. Yes, you can use your Revolut card when abroad. It allows our group members to register with a

The rest of the world (outside the EEA) You can take out 200 for free every 30 days, and well charge 3% after that. 24, Road 101, East riffa, Al Hunainya 901, Riffa +973 17666776 +973 17666779 Customers can chose from either a Visa or MasterCard both of which are accepted worldwide. For day to day spending and access to your cash. Bldg. 453 reviews. Search: Add Revolut Bank Account To Paypal. Plus, get up to S$210 Cash credit if you are amongst the first 200 new-to-UOB cardm Plus users have 200 per month in fee free ATM withdrawals. 2. level 2. Revolut Spain (FULL REVIEW) - Is it a good bank account Revolut Card in Ireland : A Summary. Depending on the ATM location, it may or may not charge fees. Yes, you can use your Revolut card when abroad. It allows our group members to register with a  With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. For other currencies, there is a 1% fee. The first is simply called Premium and it costs 7.99/6.99 per month. Above these limits, you will pay a 2% fee on all funds withdrawn, with a minimum fee of 1 per withdrawal. The best way to load a large amount of money into your Revolut account is via a bank transfer. The additional benefit here is that the physical card is a However, a money transfer company will allow you to secure a rate before you send the money in. (At the weekend there is a 0,5% cost.) Watch out for fees though - some firms will charge you for topping up, spending and withdrawing cash. Needless to say, this is a less than perfect solution to spending your money abroad. Ukraine Revolut charge 1% fee during the week and 2% on weekends, while exchaning this currency. Here is an overview of the charges: A spare Revolut card costs 5 + 5 delivery fee. Using revolut abroad.

With the Revolut travel card, you can transfer money abroad in 30+ currencies with the interbank exchange rate, with a small 0.5% fee for anything above 1,000 each month during the weekdays. For other currencies, there is a 1% fee. The first is simply called Premium and it costs 7.99/6.99 per month. Above these limits, you will pay a 2% fee on all funds withdrawn, with a minimum fee of 1 per withdrawal. The best way to load a large amount of money into your Revolut account is via a bank transfer. The additional benefit here is that the physical card is a However, a money transfer company will allow you to secure a rate before you send the money in. (At the weekend there is a 0,5% cost.) Watch out for fees though - some firms will charge you for topping up, spending and withdrawing cash. Needless to say, this is a less than perfect solution to spending your money abroad. Ukraine Revolut charge 1% fee during the week and 2% on weekends, while exchaning this currency. Here is an overview of the charges: A spare Revolut card costs 5 + 5 delivery fee. Using revolut abroad.  Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card.

Revolut gives you free ATM withdrawals up to the equivalent of 200 per month. International payments outside of SEPA: 0.30 5.00 depending on size. Free Worldwide ATM Withdrawals with Your Travel Card.